Dispense As Written Prescription Instructions and Their Impact on Plan Sponsors and Participants

by Joe Schmidt, MBA, Vice President | Team Lead

Before the days of electronic prescribing, you might have seen a pre-printed statement at the bottom of a prescriber’s written prescription that stated, “Dispense As Written,” preceded by a check box. This was the result of generic drugs first entering the market once a branded drug’s patent expired, which created multiple sources for the same drug but at different prices.

With the introduction of generics and the financial savings that they offered, states passed generic substitution laws to encourage generic dispensing, but prescribers and patients were initially concerned with the safety and quality of generic drugs.1 As a result, prescribers and patients were allowed to instruct the pharmacist to dispense the medication “as written” by the prescriber to ensure that the patient received the branded medication if requested. This may have made sense when patients paid for the full cost of their prescriptions, but with rising drug prices, it could create unintended financial consequences for the Plan Sponsor when prescription drug coverage is provided as an employee benefit.

Generic drugs, by definition and to be approved, must be identical to the brand version in dosage, safety, effectiveness, strength and quality, as well as in the way they are taken and used.2 Generic drug manufacturers can only compete on price and availability.

Growing up in a one-wage-earner household with seven brothers and sisters, I was subjected to the same budget and “benefit” philosophical issues faced by most Plan Sponsors and prescription drug benefits – we couldn’t afford everything and we wanted to cover as many priorities as our family budget would allow. As a result, each August I would be given only the money required to purchase a basic pair of blue jeans for school – anything over that amount had to be covered by me, even though I could assure you that the brand of jeans with the little red tag attached to the back right pocket would make me healthier, smarter and more productive than the basic pair for which I was funded. The “brand manufacturer” worked hard to convince me and my parents that having their brand of jeans was just as necessary as sending me to school, and I would have appreciated having the power to insist that the store provide me with the branded pair of jeans at my parents’ (rather than my) expense.

With many plan sponsors seeing an increase in utilization and cost in this category, we want to focus on several of the medications currently Plan Sponsors (like my parents) have ways to mitigate the financial impact of DAW decisions by others. In the same way that I was not given access to my parents’ money without stipulations, Plan Sponsors can decide who pays for the extra cost associated with DAW instructions – should the member pay the difference when they want the brand? How about when the prescriber wants the brand dispensed without regard to the additional cost and lack of additional clinical benefit?

- The PBM may assign multi-source brands non-preferred status on the formulary (preferred drug list) and the member/patient will pay the non-preferred copay instead of the preferred brand copay. However, it may still make the multi-source medication, net of member contribution, more expensive for the Plan Sponsor than the preferred generic for no clinical or rebate benefit.

- “REMS” is an acronym generated by the FDA. Drugs covered by mandatory REMS programs are typically required to be dispensed from a very limited number of “REMS certified” pharmacies because of safety concerns. The FDA defines a REMS program as follows:

- The PBM may exclude multi-source brands from coverage altogether.

- The Plan Sponsor can implement a program edit that basically covers the cost of the generic drug and, if the prescriber or the patient insists on the brand, then the member pays the applicable copay plus the difference in cost between the brand and its generic alternative. By covering the generic cost but not the brand cost, the Plan Sponsor mitigates the financial impact of a prescriber or member decision that is not supported clinically, but the patient still preserves their choice of receiving the branded medication if they’re willing to “pay the cost difference.” Any amount paid as a difference between costs should not apply to their deductible or out-of-pocket maximums. A prior authorization process can be put in place to evaluate the prescriber’s justification, and only with prior approval would the cost of the brand be covered by the Plan Sponsor.

Generic substitution and dispense-as-written (DAW) rules are not applicable to drugs that are protected by patents (“singlesource” drugs) and have no generic equivalents. One risk of implementing this strategy is that the prescriber may select a branded medication within the therapy class that does not have a generic alternative, a “single-source” brand. To mitigate this

risk, there are utilization management programs that can be implemented to ensure that (1) the lower-cost generic alternative is tried and unsuccessful before the more expensive single-source brand will be covered, and/or (2) it is medically necessary and appropriate.

But what about rebates? Rebates are earned on some brands because rebates are paid by the pharmaceutical manufacturer on a set of brand drugs that have preferred coverage status (tier). However, claims processed under prescriber-instructed or patient-instructed DAW protocols are generally excluded from rebates (including minimum rebate guarantees) because the generic alternatives are in a preferred position.

As the industry has evolved, additional dispensing scenarios have been introduced that needed to be accommodated in the claims adjudication system between pharmacy and PBM. The industry adopted many “dispense as written” codes to describe what was dispensed and the financial outcome of the dispensing. Understanding how your PBM contract treats claims with these codes can have a big impact on your plan spend.

Excelsior Solutions can help Plan Sponsors understand the impact of these scenarios, evaluate strategies to mitigate their impact on Plan Sponsors and participants, and allow for an informed decision that balances the pharmacy benefit with the Plan Sponsor’s benefit philosophy and budget.

1 William H. Shrank, MD, HSHS, et al., The Consequences of Requesting “Dispense as Written,” The American Journal of Medicine, https://doi.org/10.1016/j.amjmed.2010.11.020

2 https://www.fda.gov/drugs/generic-drugs/generic-drug-facts

Joe Schmidt, MBA

Vice President | Team Lead

Joseph (Joe) Schmidt joined Lockton Dunning Benefits in July of 2020 as a member of the Excelsior Solutions team. Joe has over 25 years’ experience in the healthcare industry, including pharmacy benefit management, managed care, retail pharmacy and healthcare provider. As a Vice President, Team Lead, Joe guides clients through the PBM lifecycle, from PBM procurement and contract negotiation through managing an ongoing relationship to contract renewal and/or RFP, enabling clients to maximize savings, improve internal and member satisfaction, and deliver a more effective pharmacy benefit solution.

Digital Therapeutics, the Future of Healthcare?

by Peter Tonsits, PharmD candidate, Pharmacy Intern

and Rebecca Lich, PharmD, MBA

Are you aware the global digital therapeutic market value is expected to grow from $2.88 Billion (2019) to $13.8 Billion by 2027?8 Digital therapeutics (DTx) are defined as software that delivers a clinical action, either alone or in combination with other standard-of-care treatments.

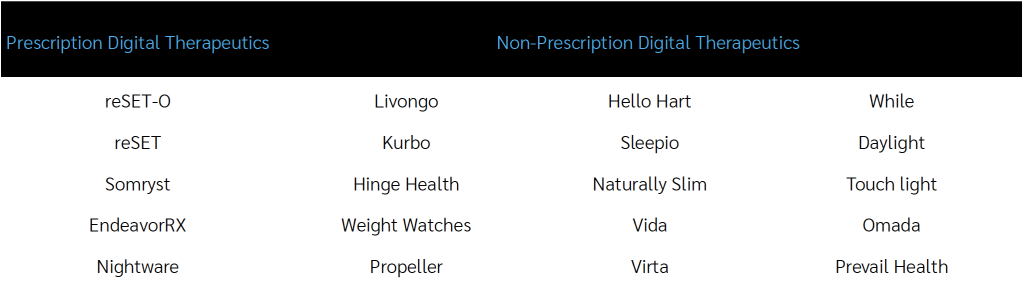

Digital therapeutics are commonly found in the form of phone apps. Since most Americans have their smartphone next to them 24/7, 365 days a year, this places the opportunity to improve healthcare at their fingertips. Digital therapeutics are indicated for over 30 disease states and thought to reduce inefficiencies in the healthcare system, improve access to care, reduce costs, increase quality and make medicine more personalized for patients.4 Like traditional medications, digital therapeutics can make claims to improve health and be approved by the FDA, and some are even billed through insurance. The FDA has approved certain digital therapeutics as prescription required (PDTx). Pricing varies greatly by device and procurement methods: ranging from as low as a few dollars per enrolled member to as high as $2,000.

Two examples of digital therapeutics:

Livongo can help patients manage their chronic conditions like diabetes. Livongo allows patients to track their blood sugars and weight using devices that conveniently upload directly to their phone. If a blood sugar reading falls out of range, an on-call coach will reach out to the patient. Additionally, the app provides actionable tips to help with healthy eating and exercise.5 This type of DTx is incorporated into an overall disease strategy and coordinated through enrollment in that program.

A prescription only digital therapy, reSET-O, is used together with medication for patients suffering from Opioid Use Disorder. It works by combining cognitive behavior therapy, fluency training and a monetary reward system. This must be prescribed by the doctor and the patient’s doctor can oversee their progress via the reSET-O dashboard while the patient completes lessons and documents medication adherence.6,7 This gives providers the chance to monitor and intervene with patients between visits while capturing and tracking data that can be used to evaluate outcomes.

While digital therapeutics are innovative and may improve care, there are many unknowns. It’s important to think about these products in context of your overall population health management strategy. The digital therapeutic market is growing quickly with new applications entering the space regularly.8,9,10 Even if a digital therapeutic is deemed safe and effective, there is often a lack of data showing its cost-effectiveness.11 Additional concerns include protecting patient data and getting physician buy-in, due to their time constraints and electronic health record integration.12

Digital therapeutics are a promising treatment avenue to bridge the gap between doctor and patient, but only time will tell where they fit in the future of healthcare. Clinical utility and cost-effectiveness should be considered for each digital therapeutic before these therapies are widely endorsed. Most PBMs exclude prescription digital therapeutics from coverage unless the plan sponsor explicitly asks for them to be covered.

1 “4 Cold Hard Facts About Health Literacy.” ProLiteracy,

www.proliteracy.org/Blogs/Article/308/4-Cold-Hard-Facts-About-Health-Literacy#:~:text=Only%2012%20percent%20of%20adults,health%20care%20and%20prevent%20disease.

2 Martin, L. R., Williams, S. L., Haskard, K. B., & Dimatteo, M. R. (2005). The challenge of patient adherence. Therapeutics and clinical risk management, 1(3), 189–199.

3 Journal Managed Care Pharmacy, 2020 May;26(5):674-681

4 “Understanding DTx.” Digital Therapeutics Alliance, 3 Feb. 2021,

dtxalliance.org/understanding-dtx/.

5 “Our Personalized Programs Make It Easier to Manage Your Health-All Paid for by Your Employer or Health Plan.We Think You’ll Love It.” Livongo,

www.livongo.com/.

6 Pear Therapeutics, peartherapeutics.com/.

7 Pear Therapeutics Presentation 2/16/2021.

8 “Digital Therapeutics Market Size Forecast By [2020-2027].” Allied Market Research, www.alliedmarketresearch.com/digital-therapeutics-market#:~:text=The%20global%20digital%20therapeutics%20market,health%20solutions%20are%20digital%20therapeutics.

9 “Digital Therapeutics and Wellness App Users to Reach 1.4 Billion by 2025.” MobiHealthNews, 28 Oct. 2020, www.mobihealthnews.com/news/emea/digital-therapeutics-and-wellness-app-users-reach-14-billion-2025.

10 “White Paper: Digital Therapeutics: Past Trends and Future Prospects.” Evidera, 7 Jan. 2021, www.evidera.com/digital-therapeutics-past-trends-and-future-prospects/.

11 Fulton F. Velez, Hilary F. Luderer, Robert Gerwien, Benjamin Parcher, Dylan Mezzio & Daniel C. Malone (2021) Evaluation of the cost-utility of a prescription digital therapeutic for the treatment of opioid use

disorder, Postgraduate Medicine, DOI: 10.1080/00325481.2021.1884471

12 “Prescription Digital Therapeutics in Behavior-Driven Conditions.” Managed Healthcare Executive, www.managedhealthcareexecutive.com/view/prescription-digital-therapeutics-in-behavior-driven-conditions?seriesArticle=prescription-digital-therapeutics-clinical-outcomes%3Futm_source&utm_medium=email&

utm_campaign=021621_PEA-20-MHD0172_MHE_Custom+eNL_Somryst&eKey=am9uYWxhbkBnbWFpbC5jb20.

Peter Tonsits

PharmD candidate, Pharmacy Intern

Rebecca Lich, PharmD, MBA

Pharmacy Practice Leader

Rebecca is a Doctor of Pharmacy. She is an expert in contract development, pharmacy claim pricing, benefit design, rebate management programs, financial analysis, auditing and adjudication of pharmacy claims.

Residency trained clinical executive with 15 years of managed care experience, including ten years’ experience with one of the largest Pharmacy Benefit Management companies (ranked Fortune 22 at its high point).

Looming Generics Require Different Tactics: Chantix & Pradaxa

by Robert Kordella, RPh, MBA

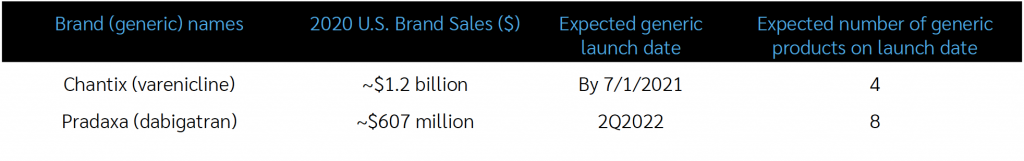

There are two generic launches pending that typify two of the many ways that generic launches, and how the tactics necessary to optimize the clinical & economic benefit from them, can vary. The first is the generic version of the smoking-cessation agent Chantix (generic name: varenicline); the second is the generic version of the direct-acting oral anticoagulant (DOAC) agent Pradaxa (generic name: dabigatran).

Chantix (varenicline)

In terms of its place in therapy, Chantix was endorsed by the American Thoracic Society (ATS) in its July 2020 Guidelines on the Pharmacologic Treatment for Tobacco Dependence, where it was strongly recommended over nicotine patches and bupropion as first-line treatment, with an extended duration of 12 weeks+ being strongly recommended over standard (6-12 week) regimens.

Chantix is likely to lose its patent exclusivity in the 1st half of 2021, with an 80% likelihood per industry estimates. There are four potential generic entrants, which will likely drive the price down sufficiently to justify excluding brand Chantix and covering only the generic versions. If four manufacturers do bring varenicline products to market, aggressive MAC pricing should be expected to be in place almost immediately. While utilization will vary, all plans will benefit from the rapid unit price erosion that is widely expected to occur soon after the approval of generic varenicline. Client PBMs will bear the burden of excluding brand Chantix and implementing aggressive MAC pricing, and Excelsior will ensure that both of those actions are promptly effectuated.

Pradaxa (dabigatran)

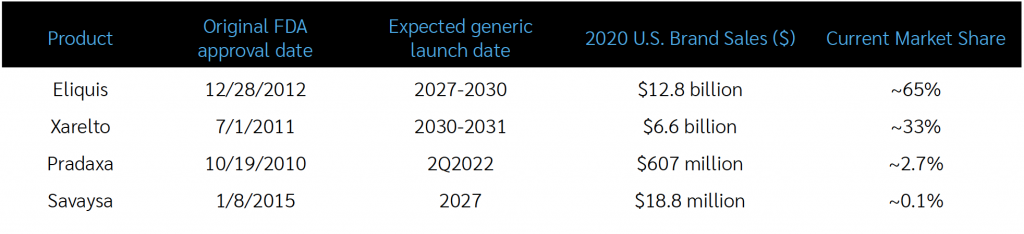

DOACs have been on the market since the FDA approved Pradaxa (dabigatran) in October 2010. Xarelto followed in 2011, Eliquis in 2012 and Savaysa in 2015. The role of DOACs is expanding, as FDA-approved indications for use in several cardiovascular conditions is increasing, although chronic use for atrial fibrillation still constitutes the majority of DOAC use today.

Pradaxa has a different mechanism of action (a “direct thrombin inhibitor”) than the other DOACs (“factor Xa inhibitors”) and a much smaller market share than the other DOACs, so a different tactic will be required to achieve significant savings from the generic. Because its loss of patent exclusivity will occur much earlier than the other products, clients will have an opportunity for savings for patients who will be newly starting DOAC therapy. The tactic, which would only apply to patients newly starting DOAC treatment, would be for Client PBMs to place a step therapy edit requiring a trial and failure of generic Pradaxa (dabigatran) prior to having access to a branded DOAC.

We do not advise that any patient currently well and safely established on a branded DOAC other than Pradaxa be converted to dabigatran upon its launch.

Client PBMs should consider the following tactics:

- Determine potential cost savings by line of business, which may vary

- Plan to grandfather current brand DOAC patients with their current product (with the exception of current Pradaxa users who will automatically convert to generic upon its launch and availability)

- For patients new to DOAC treatment, implement a step therapy edit requiring a trial of dabigatran prior to giving access to

- any branded DOAC (Eliquis, Xarelto, Savaysa), where clinically appropriate

Feel free to reach out to your Excelsior account team to discuss the particular tactics for either of these looming generic opportunities in your plan’s population. Until next time…

Robert Kordella, RPh, MBA

Chief Clinical Officer

Bob has more than 35 years of diverse experience in the pharmacy industry. Over the course of his career, Bob has led clinical and PBM operations teams in successfully managing more than $4 billion in annual drug spend. This was also while limiting per-member-per-year spending growth to levels that have simultaneously drawn industry acclaim and consistently high levels of member and payer satisfaction.

Strategies for Managing Specialty Drug Cost

by Ferrin Williams, RPh, MBA

Specialty drug cost trends continue to outpace other healthcare benefits spend. According to Excelsior Solutions’ data, most clients experience 50% or more of their pharmacy spend on specialty medications. In last month’s quarterly newsletter, Jeff Eichholz wrote an article on carving out specialty pharmacy as a strategy for managing specialty drug costs. We’re broadening the topic this quarter to include additional solutions to answer the question many clients are asking Excelsior Solutions’ Pharmacy Consultants: “What strategies are available for managing specialty drug costs?”

The most utilized pricing strategy for minimizing specialty drug costs by employer plans has been shifting a portion of the cost to the member via a higher copay on specialty medications. For example, the member will be responsible for a percentage of the drug cost. This strategy has shown minimal success in reversing the trend of high specialty drug costs for plan sponsors. Members can quickly hit their deductible and maximum out of pocket with 1-2 fills of a specialty medications if their copays are raised. Manufacturer assistance is available on most of these drugs, which can offset the member out-of-pocket cost.

Over the last few years, PBMs and carriers have started offering programs to use these same manufacturer assistance dollars to offset the plan sponsor’s cost while keeping the member cost share low to zero. Typically, the first step in this strategy is ensuring that only what the member pays for their drug is applied to their deductible and out-of-pocket maximums. The next step in the process is to capture more of the manufacturer assistance dollars on each claim to lower the cost the plan pays. This is typically done proactively by inflating the copays on these drugs via plan design updates. Some vendors will take a percentage of savings for managing these programs. Others may provide a flat fee for administering the program. We’ve seen plan sponsors save 20-25% of the specialty spend with these programs. These programs are typically limited to PPO plans and

only for medications filled through the PBM owned specialty pharmacy.

There are also third-party vendors who will integrate with the PBM to run similar programs. These third-party vendors have expanded their programs to capture alternative funding available, as well as medical tourism. Alternative funding programs seek to capture foundation or charitable organization funding for the medication. This is typically achieved through excluding coverage of the medication with this wrap feature. Most alternative funding programs require members to submit income

information for qualification. Medical tourism is a strategy for lowering specialty drug costs by incentivizing or encouraging patients to procure their specialty drugs from outside the United States where they can be purchased for a lower cost. While this may sound appealing, plan sponsors need to weigh the risk of this strategy versus the savings.

What if the plan decides not to cover specialty drugs as a part of their strategy to lower pharmacy benefit costs? There are potential compliance risks associated with not covering specialty drugs related to ADA, HIPAA nondiscrimination, ERISA retaliation and ERISA remedies that should be reviewed.

With any of these strategies, the plan sponsor will want to ensure that the chosen strategy is not inadvertently driving utilization of specialty drugs through the medical benefit by excluding or making it difficult for members to get through their pharmacy benefit. The specialty drug often costs more when billed through the medical benefit than the claim through the pharmacy benefit. Excelsior Solutions’ pharmacy consultants have the expertise necessary to assist plan sponsors with strategies that align to their goals while making an educated and informed decision.

Ferrin Williams, RPh, MBA

Pharmacy Consultant

Ferrin demonstrates strong business acumen combined with natural talent for leadership, providing a variety of large local and national employer groups with strategic consulting and technical service, to effectively lower

cost of care while improving employee health outcomes. Ferrin is an executive change agent with an in-depth understanding of health care administration products across the PBM business. She is known in the industry as an operations strategist recognized by staff and peers as an inspirational leader dedicated to nurturing rising talent and building diverse, crossfunctional teams driven by performance.