Specialty Drug Manufacturer Assistance Programs And Your Plan

by Sarah Martin, ASA, MAAA, FCA, CEBS, Vice President

Manufacturer assistance, also known as patient assistance programs, copay assistance, copay coupons, or copay cards, is intended to help members with the out of pocket costs of their specialty medications. Manufacturers provide assistance in an effort to remove financial barriers to patients staying on their medications.

This article’s discussion focuses on specialty drug assistance only. Strategies around managing non-specialty assistance are different. We will also limit our discussion to assistance available to members of commercial plans, without any requirements around financial need or income.

The amount of assistance varies by drug. Many specialty drugs have assistance available that reduces the member’s out of pocket costs down to $10, $5, or even $0 per month. While we do not foresee assistance going away anytime soon, given the changing dynamics in the pharmacy industry, manufacturers could change or stop their programs at any time.

It’s important to understand and be intentional about how assistance is used under your plan. Here are a few common scenarios:

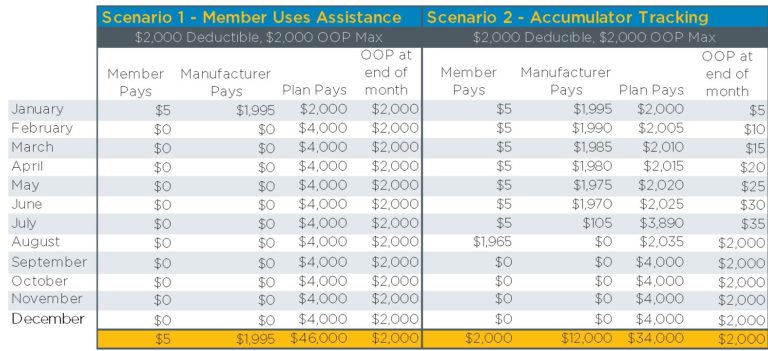

Scenario 1: Members utilize assistance as if it were their own money. Assistance counts towards the members’ deductibles and out-of-pocket maximums (also known as accumulators). The assistance can help members hit deductibles and out-of-pocket maximums earlier in the year than they would otherwise.

Scenario 2: Members may use the assistance, but it does not count towards accumulators. The members’ true out of-pocket costs are tracked and applied to deductibles and out-of-pocket maximums. This is known as “accumulator tracking”.

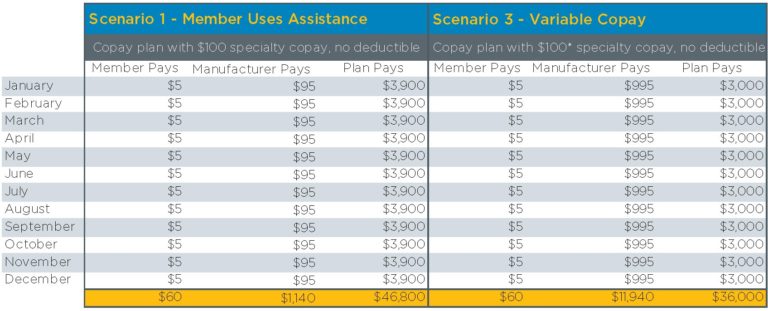

Scenario 3: Benefit plans use a variable copay mechanism to adjust copays up to maximize use of the available assistance. Copays vary by drug, based on the maximum amount of assistance the manufacturer will provide. For example, a drug may have a maximum annual assistance amount available from the manufacturer of $12,000. In this case, the copay is set at $1000 per month. Members may use the assistance, and the plan also enjoys the benefit of the assistance to the full extent allowed by the manufacturer. This is known as “variable copay”.

For many years, most employer plans operated under Scenario 1. PBMs were often unable to identify and track utilization of assistance. But employers started to realize how quickly certain specialty drug utilizers were “artificially” hitting their deductible and out-of-pocket maximum for the entire year because of the assistance picking up the bulk of the cost.

In reaction to this, some employers with high deductible plans decided to start tracking accumulators, under Scenario 2. PBMs developed capabilities to track and adjust accumulators if members filled specialty drugs through the PBM’s own pharmacy where utilization of assistance was visible.

Very recently some employers, particularly those with specialty drug copays, started operating under Scenario 3 to maximize the available assistance and shift value to the plan. Not all PBMs offer variable copay programs, and some charge a fee. Plans operating under Scenario 3 can experience significant savings, depending on their plan design. Because “variable copay” is a plan design change, there may be Summary Plan Description language changes needed.

Example of how accumulator tracking works for a plan with a deductible:

Suppose a member takes a specialty drug with a monthly $4,000 cost and has no other medical or pharmacy claims for the year. There is a manufacturer coupon that pays up to $12,000 a year, if the member pays $5 per month. In this example, the plan saves $12,000 for this member over the course of the year by implementing accumulator tracking:

Example of how variable copay works for a plan with flat copays:

Suppose a member takes a specialty drug with a monthly $4,000 cost and has no other medical and pharmacy claims for the year. There is a manufacturer coupon that pays up to $12,000 a year, if the member pays $5 per month. In this example, the plan saves $10,800 for this member over the course of the year by implementing accumulator tracking:

¹Plan’s standard copay is $100, but under variable copay program copay is effectively adjusted to $1,000.

Impact on members

Particularly for members under a high deductible plan, going from Scenario 1 to Scenario 2 can be disruptive. In our example, the member paid $5 for the entire year before hitting their out of pocket maximum. With accumulator tracking implemented, the member pays $2000. Moreover, they have a surprise in August when their copay assistance runs out, and they go from paying $5 per month for their drug to $1,965 to fulfill their deductible and out of pocket maximum.

For members who have a flat copay on specialty drugs, a variable copay program is invisible to the member—they still pay $5 per month. Under some PBM variable copay programs, members pay nothing, and the plan picks up the $5 member cost share, so members actually benefit from the variable copay program.

Questions to ask as you evaluate specialty manufacturer assistance programs:

Does my PBM offer accumulator tracking and/or variable copay programs?

Are there fees for these programs?

Do I meet the requirements for the program? For example, your plan will likely be required to fill all specialty drugs through the PBM’s specialty pharmacy.

Given my plan design, which program is best from a financial perspective? From a member disruption perspective? Note, Scenario 2 often increases member cost, and Scenario 3 often lowers member cost, but it depends on your plan design.

Are there compliance issues to consider, such as SPD changes?

How is this communicated to my members?

Will I receive savings reports from my PBM?

Sarah Martin, ASA, MAAA, FCA, CEBS

Vice President

Sarah has been in employee benefits for 12 years. She is a credentialed actuary responsible for clients’ financial deliverables and strategy. Sarah has been a guest speaker for the Conference of Consulting Actuaries, the Pharmacy Benefit Management Institute, and the International Society of Certified Employee Benefits Specialists.

Her primary areas of expertise include pharmacy benefit management procurement and contracting, cost forecasting, data analysis, plan design, predictive modeling, and emerging pharmacy benefit strategies.

Considerations In Favor Of Formulary Management

by Robert Kordella, RPh, MBA, Chief Clinical Officer

Physicians possess deep knowledge surrounding the pharmacology and clinical use of drugs. Unfortunately, most physicians do not have a similarly deep grasp of the absolute and relative costs of drugs. A formulary is a pharmacy benefit management tool designed to help bridge that information gap for both physicians and plan members.

A formulary is defined by the Academy of Managed Care Pharmacy as, “A list of drugs approved for use in a given setting that establishes prescription drug/class coverage rules and/or the level of coverage (i.e., patient paid amounts).”

When a physician doesn’t have a strong clinical preference about the slight differences in effect that may exist among several therapeutically equivalent drugs, they are said to be “clinically indifferent” to those various alternatives. In such cases of clinical indifference, the low net cost option is the best option, and a formulary is one way to identify those low net cost options. When higher cost, therapeutically equivalent drugs are removed from consideration for prescribing they are said to be “excluded” from the formulary.

What about rebates? Rebates are neither a slush fund, nor are they the enigmatic “free lunch.” On the contrary, they come with significant performance strings attached. They are contractually defined as payments for incremental market share that are attained at the expense of a contractually defined competitive drug or drugs. Certain drugs must be excluded (or otherwise disadvantaged via co-pay or utilization management rules) to optimize rebate payments. It also requires expertise and insight to understand where and when optimizing rebates makes sense considering other alternatives, including generic and biosimilar options. Implementing a formulary with exclusions can enable the plan sponsor to earn rebates 20-30% higher.

For members, formulary development work ensures that sufficient options are available to meet every clinical need while managing their out-of-pocket costs.

At Excelsior, we perform the following activities that tie all of these moving parts together:

- Ensure that every dollar spent on the pharmacy benefit is spent wisely in light of available alternatives

- Drive out unintended clinical risk

- Preempt surprises surrounding drugs in the developmental pipeline prior to their launch

- Identify where and when chasing incremental savings rebates makes sense, and where and when it doesn’t.

Important considerations in favor of excluding certain drugs from formularies:

- Products having materially higher costs relative to clinically reasonable Rx or OTC alternatives.

- Products having materially higher costs relative to clinically reasonable alternative dosage forms.

- Products having materially higher costs relative to clinically reasonable similar, but not identical, strengths.

- Combination products having materially higher costs relative to their constituent components purchased separately.

- Products made by certain manufacturers that have developed a reputation for predatory pricing practices

- Generic product re-branded (alternatively, “resurrected” or “reincarnated”) as a brand product at a materially higher price.

- Product type not typically covered under Rx benefit / e.g., DME or Medical Supply items.

- Product rebate optimization plays vs. defined competitive, clinically indifferent brand alternatives.

- Therapy classes with multiple clinically equivalent options where you can minimize cost by reducing coverage to one or two medications.

Robert Kordella, RPh, MBA

Chief Clinical Officer

Bob has more than 30 years of diverse experience in the pharmacy industry. Over the course of his career, Bob has led clinical and PBM operations teams in successfully managing more than $4 billion in annual drug spend. This was also while limiting per-member-per-year spending growth to levels that have simultaneously drawn industry acclaim and consistently high levels of member and payer satisfaction.