The Impact Of Humira Citrate-Free

by Bob Kordella, R.Ph., MBA

Humira is typically in the top five drugs by spend for most plan sponsors. In January 2020, Abbvie, the manufacturer of Humira, increased the Average Wholesale Price by 7.4%. In addition, it is the most advertised drug to consumers. Multiple biosimilars have been approved by the FDA that would theoretically lead to reduced cost. However, AbbVie has successfully undertaken steps to ensure their market leading position into the future. Let’s take a look at some of them and explore what options might be available to manage this treatment in the face of these tactics.

First, AbbVie negotiated several legal agreements with competitors who planned to market biosimilar versions of Humira that have delayed the launch of the first biosimilar version of Humira until January 31, 2023 even though they have already been approved by the FDA. You can read about those efforts here and here.

At the same time that AbbVie’s attorneys were at work delaying biosimilar competition, AbbVie’s R&D team was busy reformulating Humira into a new version called “Humira Citrate-Free.” Citrates are inactive chemical ingredients that have long been included in many injectable medications as one way to extend their shelf life, but their presence may cause pain on injection. Both versions of Humira, original and citrate-free, currently have the same price (average of approximately $6,000 per month, in terms of discounted ingredient cost).

In addition to removing the citrates, Humira Citrate-Free has the same dose contained in half the volume of liquid and is packaged with a thinner needle in the auto-injector, both additional product features that make the injection less painful to receive.

As a result, AbbVie has launched a series of advertisements touting the less painful citrate-free version of Humira directly to patients with a typical, “Ask your Doctor about…,” suggestion. As a result of these advertisements, combined with other professional marketing efforts, approximately 60% of the Humira market share has already converted to the citrate-free version. While these changes may make the injection less painful, there is little evidence this meets a clinical need. Patients were not stopping therapy due to injection site pain.

Finally, when the biosimilar versions of Humira do ultimately launch in early 2023, they will only be deemed biosimilar to the original version of Humira. Regardless of whatever savings my exist, it will be a difficult task to get both physicians and patients to agree to convert from a less painful to a more painful injection.

What can be done? Humira faces competition from some newer products that treat the same conditions but have different mechanisms of action. In some patients, these newer products produce better clinical outcomes. As physicians use more of these newer products, their reliance on Humira may decline over time.

On the regulatory front, in early February, 2020, the FDA and Federal Trade Commission (FTC) jointly announced plans to address anti-competitive practices that limit biosimilar product adoption. In addition, the FTC also announced that it would examine so-called “pay-to-delay” patent settlements, such as the ones negotiated by AbbVie to forestall Humira’s biosimilar competitors from entering the market.

If you would like to discuss tactics to manage the conversion of Humira patients to Humira Citrate-Free, please reach out to your Excelsior account team and we will be happy to set up a call.

Robert Kordella,

R.Ph., MBA Chief Clinical Officer

Bob has more than 30 years of diverse experience in the pharmacy industry. Over the course of his career, Bob has led clinical and PBM operations teams in successfully managing more than $4 billion in annual drug spend. This was also while limiting per- member-per-year spending growth to levels that have simultaneously drawn industry acclaim and consistently high levels of member and payer satisfaction.

Will Peanut Allergy Drugs Be The Next Billion-Dollar Class?

By DeeDee Tillitt, MBA

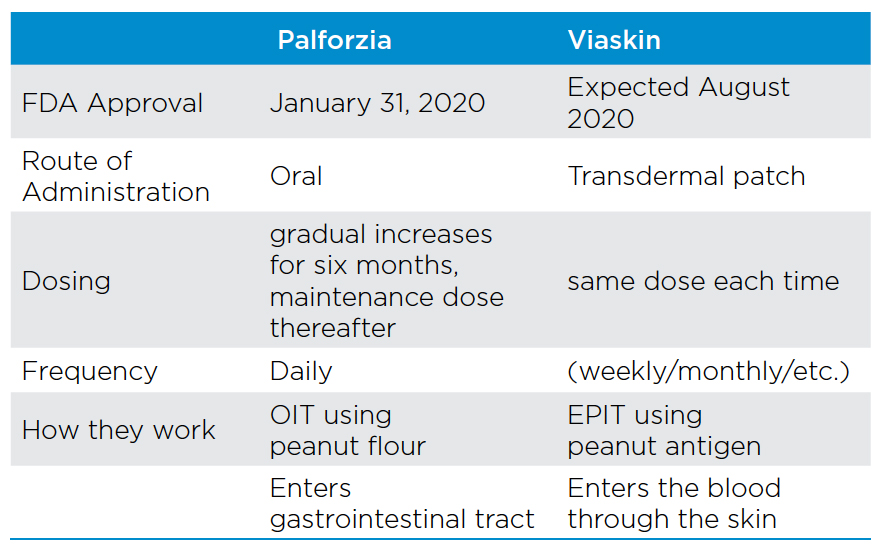

On January 31, 2020, the FDA approved Palforzia, the first drug to treat children who suffer from peanut allergies, which can be a scary and life-threatening condition. A second drug, Viaskin, is scheduled for review by the FDA this summer giving parents long demanded options.

In the US, it is estimated that 2.2% of children (roughly 1.2 million) have a peanut allergy, and that percentage continues to increase. Each year in the US approximately four children per year die from an allergic peanut reaction. Historically, those with the affliction have had to rely solely on avoidance of all peanuts and any of its byproducts, with an emergency back-up plan of carrying an EpiPen. For children, besides the anxiety this strategy has caused, it has also led to isolation and struggles with eating outside of the home. The two drugs for peanut allergies are very different in how they work, how they are administered, when they’ll be available to patients and prescribers.

Palforzia (AR-101), developed by biotech firm Aimmune Therapeutics, received FDA approval for patients between 4 and 17 years of age. The treatment is an oral immunotherapy (OIT) and works by desensitizing people to their peanut allergy. The process involves taking a daily capsule that has peanut flour as the main ingredient. The dosing is gradually increased over a six-month time frame, building up a tolerance for peanuts, after which patients are put on a maintenance dose for life. Although non-FDA approved OIT has been used by some allergists for a long time, the lack of regulation and standardization has limited its use and accessibility for most patients.

Patients being treated with Palforzia will still not be able to eat peanuts, but the risk of a life-threatening event is greatly diminished when peanuts or its by-products are inadvertently ingested. Due to the lack of history or experience with the new drug, the patient is also required to continue to carry an EpiPen as a rescue measure.

Because Palforzia comes with risks and side effects, the FDA committee recommended that Palforzia have a Risk Evaluation and Mitigation Strategy (REMS) program along with adherence to strong package labeling. Because patients are being exposed to peanut protein, the risk of anaphylactic reactions are of huge concern and have made the treatment somewhat controversial.

The second and perhaps more promising peanut allergy drug, Viaskin, has been submitted to the FDA by the French biotech firm, DBV Technologies. Viaskin is a transdermal patch used to deliver epicutaneous immunotherapy (EPIT). The FDA is expected to have its first review of the product in August 2020.

EPIT is based on continuous antigen exposure at the same dose instead of small dosing increases like OIT. Another difference between the two drugs is Viaskin uses a peanut antigen instead of peanut flour. A third difference is Viaskin enters the blood through the skin while Palforzia enters the gastrointestinal tract. Based on studies to date, Viaskin appears to have no serious side effects making it a more attractive option than Palforzia.

For payors, the struggle is avoidance versus the cost of potential lifetime treatment. The Institute for Clinical and Economic Review (ICER) reported that the net health benefit for Palforzia and Viaskin had not proved superior to avoidance alone. However, the quality of life could be positively impacted. Palforzia will have a list price of $890 per month and will need to be taken indefinitely.

Recommendations for managing Palforzia

- Restrict prescribing to Allergists due to the complexity and need for monitoring

- Restrict the age to 4 or above per FDA labeling

- Clinical documentation of peanut allergy

- Authorize for no more than one year at a time to force an assessment of on-going benefit

Viaskin is expected to be priced similarly to Palforzia. Because no other medical treatment is available for those with a peanut allergy, we do anticipate that both drugs will be covered. Excelsior Solutions will continue to monitor this dynamic market space and share all updates.

DeeDee Tillitt, MBA

Vice President

DeeDee has over 15 years pharmacy consulting experience with various types of clients throughout the country. DeeDee has extensive Managed Medicaid experience including working with several plans throughout the country. DeeDee’s experience includes managing her clients’ PBM contracts through RFP selection, contract negotiation, implementation as well as on-going management and consultation through-out the life of the PBM contract. In the complicated areas of Specialty Rx and 340 Pricing, DeeDee has successfully advised her clients on the various vendors and pricing models available to best match their organization and their organization’s mission. Through DeeDee’s industry insight and guidance her clients have been able to achieve financial savings, operational effectiveness and clinical best practices.

DeeDee holds an MBA from St. Thomas University and earned her Bachelor of Arts degree from the University of Minnesota.

Drug Prices Increase AGAIN…

Can We Look To The “True North” For Relief?

by Greg Bigwood

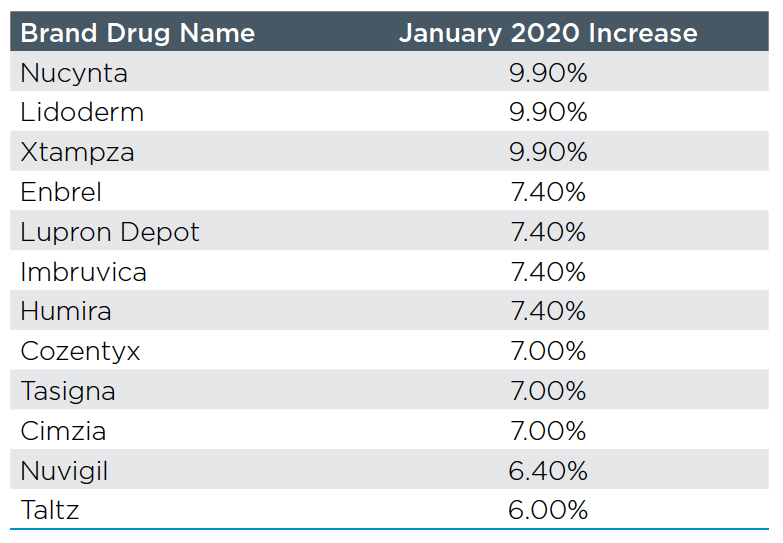

The customary New Year’s present to payors from drug manufacturers is a price increase on their products. 2020 has started out little different with nearly 500 brand drugs increasing prices by an average of 5.2% within the first two weeks of the year. Enbrel and Humira continued their lock step increases by taking their biggest increase in 3 years at 7.4%. See the table with the top twelve brand drug movers.

The biggest increases came in generic drugs. Generic Viread (tenofovir) lead the way with an increase in AWP from $69.60 to $1151.77–over 1500% on 1/1/2020. Although generic AWP increases may not increase the overall cost of generic drugs due to MAC pricing, they will make it easier for the PBM to meet their generic effective rate guarantees next year since the denominator will be larger.

Many were hoping for drug price relief when the Trump administration announced that it was going to move forward with allowing states to safely import drugs from Canada for the first time. However, it is important to note that many of the most expensive drugs, including insulin and many injectable drugs, would be excluded from this proposal due to a law from 2003 that limits importation of these type of drugs. Within 48 hours

of the release of this announcement, news came from Toronto and Ottawa that showed major issues. After the state of Florida filed plans, Canadian drug distributors and industry groups that represented all potential suppliers of drugs to the United States told Reuters that they would not participate due to “product and drug shortages” and concern that “this initiative may exacerbate what is already a critical issue.” A 2019 study projected that if 40% of US prescriptions were filled from Canada, the Canadian drug supply would run out in 118 days. In fact, the state of Florida alone spends more on prescription drugs than all of Canada. We do not see manufacturers sending more volume to Canada only to have it sent to the United States at a lower price than if it had been sold directly in the United States. As States and the Federal Government continue to wrestle with the drug cost challenges, Canadian importation may not be the quick solution some were hoping it could provide.

Greg Bigwood

Vice President

Gregory possesses more than 15 years of diverse healthcare experience. Having spent several years in PBM finance and underwriting, his deep understanding of PBM financials and operations ensures chat his clients receive and maintain significant financial savings backed by unparalleled levels of service.

Gregory delivers expertise in contract negotiation, RFP management and ongoing consultation with clients. He has been a featured national speaker on topics such as specialty drugs, RFP management, PBM pricing, Medicare Part D compliance, and PBM audit (both Medicare and non-Medicare).