What is the Purpose of the Drug Watch List?

by Bob Kordella, RPh, MBA, Chief Clinical Officer

One of the truths surrounding the pharmaceutical industry is that not every drug is a block-buster or a breakthrough treatment. During this “golden age” of pharmaceutical development we have grown accustomed to the launch of new drugs that cure diseases that were previously untreatable, or that advance drug therapy to such an extent that a substitute will not suffice.

Unfortunately, not every drug is a break-through treatment. The truth of the matter is that some of these new drugs have an egregious price or no clinical value. Do you realize a lotion can cost $8,000?

How is a plan sponsor to know the difference between high-value, necessary drug products and low-value drug products that require further scrutiny?

That question is what prompted Excelsior Solutions to develop the Drug Watch List. The purpose of the Drug Watch List, which is an important part of our standard client report book, is to flag certain low-value drugs for extra scrutiny, and to suggest alternate means by which the clinical need at hand may be better met from a clinical and/or cost perspective.

We have identified seven categories to classify drugs targeted for inclusion on the Drug Watch List. They are the following:

Watch List Categories

- Products having materially higher costs relative to clinically reasonable Rx or OTC alternatives.

- Products having materially higher costs relative to clinically reasonable alternative dosage forms.

- Products having materially higher costs relative to clinically reasonable similar, but not identical, strengths.

- Combination products having materially higher costs relative to their constituent components purchased separately.

- All products made by certain manufacturers that have developed a reputation for predatory pricing practices.

- Formerly generic products that have been rebranded and relaunched as brand products.

- Product types not typically covered under the Rx benefit such as durable medical equipment or medical supplies.

The Drug Watch List has already produced important results for Excelsior Clients.

- A manufacturing client identified and excluded the drugs Duexis and Vimovo (reason #4 above) and saved $162,000 annually. Both drugs are combination products where the individual components are available for much less.

- A hospital system client identified and excluded a Dermacin Surgery pack product (reason #7 above) and saved tens of thousands of dollars annually. This product contains a topical antiseptic, lotion, and tape but is priced at over $5,000.

- Another manufacturing client identified issues surrounding dosage forms and strengths (reasons 2 and 3 above) of doxycycline, an antibiotic primarily used for acne, saving approximately $22,000 annually, and an additional $41,000 by encouraging the use of lower potency topical steroids as initial therapy (reason #1 above).

The Drug Watch List is another tool that we use to ensure that every dollar that you spend on your Pharmacy benefit is spent wisely considering other available alternatives, and it is another reason why you can trust Excelsior Solutions to be your vigilant partner in managing and optimizing your Pharmacy benefit.

Robert Kordella, RPh, MBA

Chief Clinical Officer

Bob has more than 30 years of diverse experience in the pharmacy industry. Over the course of his career, Bob has led clinical and PBM operations teams in successfully managing more than $4 billion in annual drug spend. This was also while limiting per-member-per-year spending growth to levels that have simultaneously drawn industry acclaim and consistently high levels of member and payer satisfaction.

Little Relief In Sight For Drug Price Inflation In 2019

by DeeDee Tillitt, MBA, Vice President

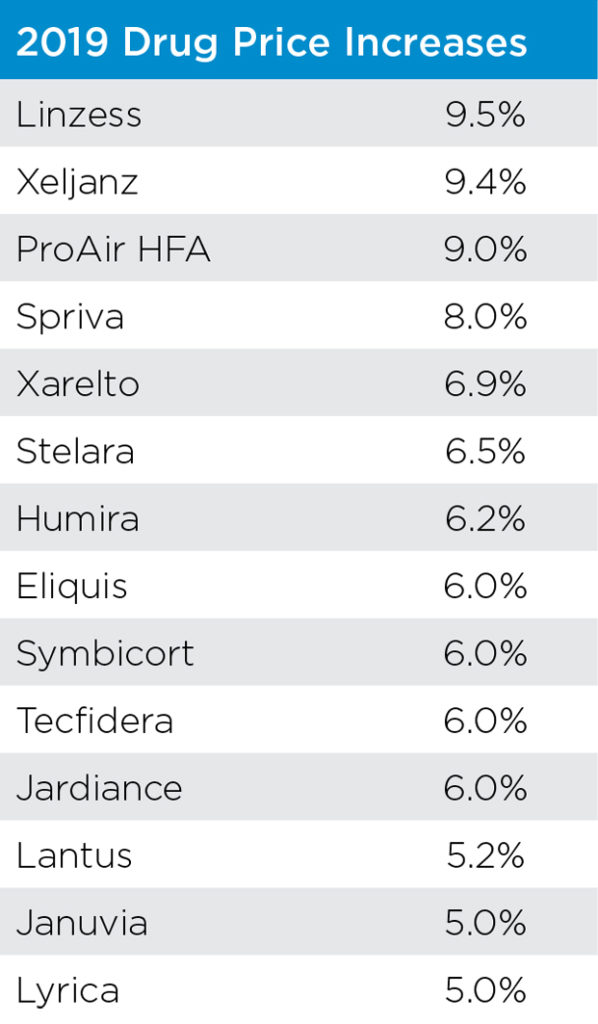

Although the drug manufacturers, or Pharma, took a break from price increases in the second half of 2018, January brought a storm of price increases with over 30 manufacturers taking their customary New Year’s increases on over 250 drugs. Once again some of the most popular drugs had their prices increased by 5%-9.5% which was slightly lower than 2018’s percentage.

Although insulin drugs only averaged a 5-6% increase this year, price increases have become so flagrant that the Senate recently held hearings with the drug manufacturers that control the insulin market. According to the New York Times between 2010 and 2015 insulin prices have increased 168% for Lantus (made by Sanofi), 169% for Levemir (made by Novo Nordisk) and a whopping 325% for Humulin (made by Eli Lilly). Several States Attorneys General have filed lawsuits claiming patients are dying after trying to ration their insulin due to the high cost. Eli Lilly announced on March 4th they will introduce a generic version at half the current list price.

In attempting to address the increasing cost of drugs in the US, the Trump administration has put forth two different programs.

Recently, the Department of Health and Human Services (HHS) announced their plan to eliminate the $29 billion in rebate payments that drug manufacturers pay to Pharmacy Benefit Managers (PBMs) for Medicare and Medicaid plans. The drug manufacturers would instead pay some unknown rebate amount to the patient who uses the drug to offset their copay expense. This model could create numerous problems including encouraging patients to select a high cost drug over a lower cost drug, increase Medicare premiums due to lost revenue and increase every State’s share of funding for Medicaid. The beneficiaries of this proposal would be the patient who receives the rebate payment and the drug manufacturers. The proposal is currently under a 60-day comment period. HHS Secretary Alex Azar is now calling on Congress to eliminate rebates in the commercial insurance market as well so whatever is decided with the HHS proposal could have an indirect impact on the commercial market.

The second program to come under scrutiny is the 340B drug pricing program which was created to help fund not-for-profit hospital and clinics that serve those patients without insurance or lack of access to care. The program is fully funded by Pharma by way of selling drugs at a great discount, typically over 50% of Average Wholesale Price (AWP), to these qualified entities. The covered entities whether it’s a hospital or clinic then use this revenue to support their programs and patients in many ways including low cost or free drugs. Currently a proposal to reduce by 30% some of the payment’s hospitals receive through this program is blocked by the Federal court.

The problem with both “solutions” is that they give money back to the drug manufacturers who have created the crisis in drug pricing. In an article by Tracy Station in FiercePharma (2.1.19), a Bernstein analyst says the proposed rule change is a good thing for Pharma as it doesn’t shackle Pharma’s ability to raise drug prices. The PBMs claim to pass through majority of the rebates received to the end payors so changes will lead to increase in premiums on all patients. To hope that these companies will now be motivated to lower drug prices is very naïve at best. HHS Secretary Alex Azar told reporters it’s basically impossible to predict how the market will behave. So, what is the answer? As we should all know by now, nothing in US healthcare, including prescription drugs, is easy to fix or fully understand. But knowing that means a comprehensive drug policy needs to ensure it’s not creating a bigger problem somewhere else.

DeeDee Tillitt, MBA

Vice President

DeeDee has over 15 years pharmacy consulting experience with various types of clients throughout the country. DeeDee has extensive Managed Medicaid experience including working with several plans throughout the country. DeeDee’s experience includes managing her clients’ PBM contracts through RFP selection, contract negotiation, implementation as well as on-going management and consultation through-out the life of the PBM contract. In the complicated areas of Specialty Rx and 340 Pricing, DeeDee has successfully advised her clients on the various vendors and pricing models available to best match their organization and their organization’s mission. Through DeeDee’s industry insight and guidance her clients have been able to achieve financial savings, operational effectiveness and clinical best practices.

DeeDee holds an MBA from St. Thomas University and earned her Bachelor of Arts degree from the University of Minnesota.

Point of Sale Rebates – What’s Old is New Again

by Greg Bigwood, Vice President

Our clients often ask us about the future of rebates. According to the National Business Group on Health, over 90% of employers would welcome an alternative to the rebate-driven approach to management of drug costs. An alternative that has been in a lot of discussions lately has been point of sale rebates. As the gross-to-net bubble continues to grow (Adam Fein of Drug Channels estimates it at north of $150 Billion), plans are more and more often looking at rebates as a necessary evil to control their prescription plan spend. There are many in the industry who see this gross-to-net bubble as an unsustainable equation. Because of the growth of coinsurance and high deductible plans, members are often paying the high cost of the medication without any of the offset of the retrospective rebate. The Trump administration has made several public statements and authored proposed rules for Medicare Part D and Medicaid regarding the fact that drug prices need to come down.

What is it?

Although we have been hearing about them a lot lately, Point of Sale (POS) rebates are nothing new for PBMs. When I was in underwriting at a PBM in 2002, there was a major consulting house that required the ability to apply the true rebate value, by drug, as a requirement on every large employer RFP. This has also been a standard element of some pass through PBMs offering for over a decade. Although the plan setup and maintenance are not all that easy, the underwriting was simply an exercise in time value of money (i.e., rebates are being paid 6 months earlier, on average, then they would be under a standard arrangement so the cost of money for one-half of the year is underwritten.) Very few of these clients historically elected to take this option. POS rebates came back into the new 15 years later when United HealthCare and Aetna both announced plans to offer point of sale rebates to commercial fully-insured membership. Most of the major PBMs have the ability set up POS rebates in one way or another.

How does a POS rebate work?

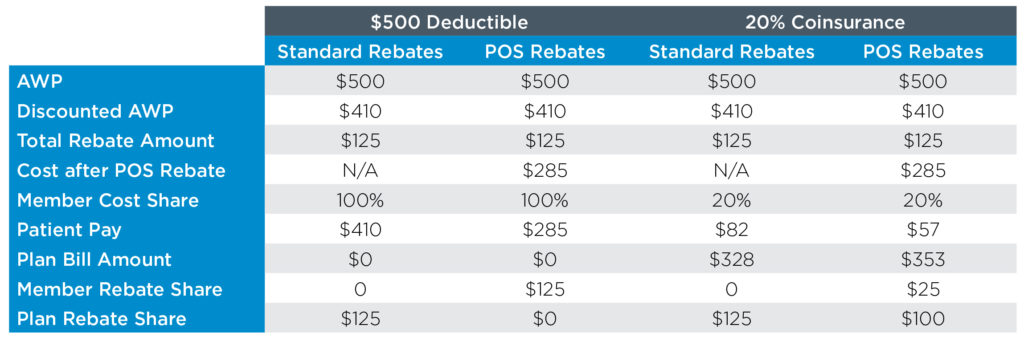

The POS rebate process allows the member to share in some or all the rebate value through a reduction in his or her copayment on certain brand medications. The amount paid is reconciled to 100% of total rebates after the fact, typically after the close of the contract year. Often the PBM will hold back a portion (5% or less) of the rebate to make the reconciliation cleaner. If the PBM overpays the POS rebate it may ask the plan for a refund at the end of the year. Below is an example of POS rebates operationally for a drug with a rebate that is 25% of AWP

As you can see (and would expect), the impact of POS rebates on the total payment to the plan is significantly larger for the member inside of his or her deductible.

Considerations for Employers and Plans

While POS rebates may seem like the right thing to do in sharing the rebates with members who are actually taking the drug, it is important to consider the financial impact of this program. POS rebates can have a significant impact on your budget. For a plan with a deductible, the entire rebate will be passed to the member during the deductible phase. In addition, the PBMs may charge to administer a POS rebate program because of the complexity and time value of money. For this reason, it is important to do a full actuarial analysis of the impact to determine how much overall plan costs will increase (post rebate). Many plans we have spoken to find increasing premium for all members in order to provide relief to higher cost members a difficult pill to swallow. It is also important to consider the fact that many of these members may be already using copay assistance cards to reduce their out of pocket share.

Gregory possesses more than 15 years of diverse healthcare experience. Having spent several years in PBM finance and underwriting, his deep understanding of PBM financials and operations ensures chat his clients receive and maintain significant financial savings backed by unparalleled levels of service.

Gregory delivers expertise in contract negotiation, RFP management and ongoing consultation with clients. He has been a featured national speaker on topics such as specialty d rugs, RFP management, PBM pricing, Medicare Part D compliance, and PBM audit (both Medicare and non-Medicare).